Nike’s “Victory Mode” tour encourages youths to discover new sports

Nike partnered with football icon Kylian Mbappé and his namesake Inspired By Kylian Mbappé foundation to host ...

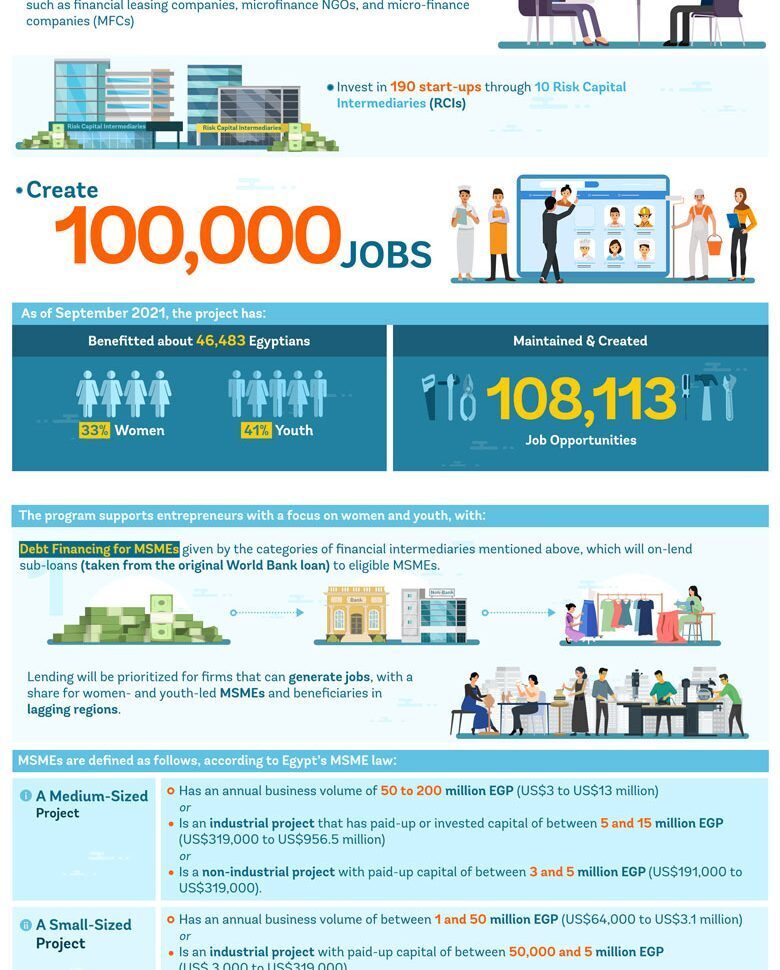

About 46,483 Egyptians benefited from the World Bank’s “Catalyzing Entrepreneurship for Job Creation” project as of September 2021, according to an infograph released by the World Bank.

The five-year project, at $ 200 million, began in January 2020 with an aim to promote entrepreneurship, combined with expanding access to finance for small and medium enterprises, which have proven to be a major source of growth and job creation. This project is designed to address the major obstacles that young people and women face when launching new businesses.

About 33 percent of the program’s beneficiaries are women, the infograph said.

The program managed to maintain and create 108, 113 job opportunities as of September 2021 as job creation is becoming increasingly integral to prosperity and stability in Egypt whose population passed the 100 million mark in 2020. About 70 percent of Egyptians are under the age of 40.

The program supports entrepreneurs with a focus on women and youth, with Debt Financing for micro, medium and small sized enterprises (MSMEs) given by the categories of financial intermediaries mentioned above, which will on-lend sub-loans to eligible MSMEs.

Lending will be prioritized for firms that can generate jobs, with a share of women- and youth-led MSMEs and beneficiaries in lagging regions.

The project focuses on three components. The first component is MSMEs which is meant to address access to finance gaps among MSMEs in Egypt and encourage greater private sector participation in the MSME market through a robust market demonstration effect.

The program aims to finance 85,200 MSMEs through 30 financial intermediaries – both banks and non-bank financial institutions, such as financial leasing companies, microfinance NGOs, and micro-finance companies (MFCs).

The second component, risk capital for innovative startups and high growth SMEs, entails the provision of equity and quasi equity investments to eligible risk capital intermediaries (RCIs) that target innovative startups and high growth SMEs in the territory of the Borrower; and associated management costs.

The program also aims to invest in 190 start-ups through 10 RCIs.

The third component, business and capacity development entails the provision of training, mentoring, coaching, and business development services to eligible MSMEs, participating financial institutions (PFIs), and eligible RCIs for part one and two of the project; provision of technical assistance to enhance MSME Development Agency (MSMEDA’s) usage of digital solutions, including for a digital matching platform aimed at connecting entrepreneurs with potential investors; and the developing of a robust monitoring framework, including for job creation under the project.

Nike partnered with football icon Kylian Mbappé and his namesake Inspired By Kylian Mbappé foundation to host ...

Adidas has announced the return of Move For The Planet– its global initiative harnessing collective movement ...

Honeywell uses solid waste, which probably known as garbage or trash; and biomass, or waste ...

اترك تعليقا